Investors

Welcome to our Investor Centre

Please click on the Profiles below to see more details on our other clients:

All of the information contained within this website has been compiled from sources believed to be reliable, but no warranty, expressed or implied, is given that the information is complete or accurate or that it is fit for a particular purpose. All such warranties are expressly disclaimed and excluded. Any opinions, recommendations and forecasts referred to are not those of Walbrook PR Limited but are expressly those of third parties, such as investment analysts and financial journalists. Such opinions, recommendations and forecasts may have been superseded and thus may not necessarily be the current opinions, recommendations and forecasts of the relevant analyst/broker. None of the content of this website should be construed as an offer to buy or sell, or a solicitation of an offer to buy or sell, the securities of any listed Company mentioned or featured herein as it is for information only. Any recommendations referred to by third parties do not necessarily imply the suitability of particular securities for individual situations. The value of securities and the income from them may fluctuate. It should be remembered that past performance is not necessarily a guide to future performance. You are strongly advised to seek guidance from a professional investment adviser before entering into any contract to buy or sell any security featured herein. By reading this disclaimer, and ticking the box below, you confirm that you accept and understand its content, and that you shall not hold Walbrook PR Limited, its directors and staff nor any of its subsidiaries or connected companies liable for any loss that you may sustain should you decide to buy or sell any of the mentioned securities.

Amcomri Group plc

Company Profile

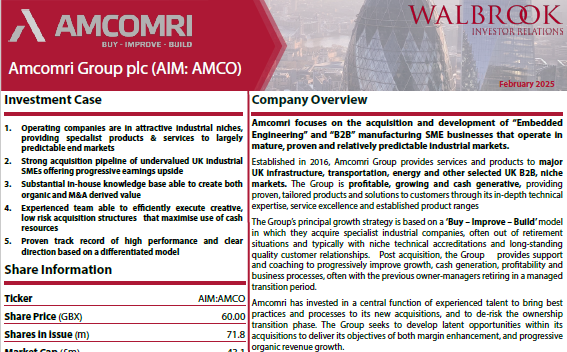

Amcomri is a “Buy, Improve, Build” group focusing on acquiring, integrating and enhancing specialist engineering services and industrial manufacturing businesses that provide technical services to major UK infrastructure, transportation and energy companies and bespoke mission-critical services to a diverse range of sectors and markets.

The Group currently operates through the following two divisions:

(i) Embedded Engineering Division: provides specialist technical and engineering services for major industrial, infrastructure and transportation clients, typically with complex technical needs and undertaken in operating environments where safety and compliance performance are critical requirements. The division predominantly provides engineering services and support for their clients’ capital intensive, mission-critical assets such as high voltage electrical transmission systems, petrochemical and continuous process operations, and large power generation plants.

(ii) B2B Manufacturing Division: focuses on selective niche B2B markets or businesses, where the Group has identified an opportunity to achieve enhanced financial performance by leveraging an initially strong competitive market position combined with the Group’s business improvement capabilities.

The Group operates across a diverse range of sectors and markets, including industrial, infrastructure and mass transportation. The Group deploys a structured “Buy, Improve, Build” strategy with a track record of value enhancing acquisitions in the industrial environment. It has a particular focus on leveraging the Group’s experience and track record in relation to acquisitions arising from owner manager ‘retirement’ situations, where there are no, or limited, alternative plans for succession to sustain the enterprise value present within the target business.

The Group has been created through a series of 16 successful acquisitions, comprising the acquisition of 12 operating companies and 4 bolt-on asset/business purchases, each of which has been integrated into the Group. The Group’s businesses have grown organically and are well placed to take advantage of generally positive conditions in their respective end markets. This strategic approach has delivered compound annual Group revenue growth of 48.8 per cent. between FY21 and FY23.

Investor Access

There is no Investor Access event planned at the moment - click on "Register your Interest" and we'll tell the Company that you'd like to attend one in the future and update you when an event is planned.